California Energy Upgrades in Sacramento

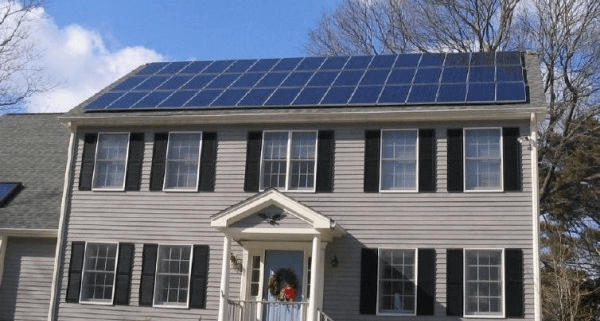

Solar Panels on your home in Sacramento, California will save you money on your electric bill.

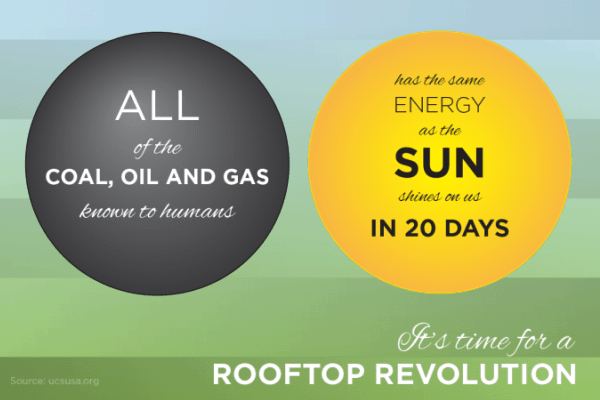

Most of California citizens do not realize how much money that they invest in energy use each year. The electricity prices in California have increased by 50% since 1990 and have been projected to increase by roughly 3-4% each year. With electricity bills projected to rise, wise home owner’s are slowly switching to alternative energy by installing solar systems in their home. If your average utility bill is $150/month, having a solar system in your home in California can help you save over $1,250 every year!! From San Diego to Los Angeles, and from the Bay Area to Sacramento, Ca home owners are earning their money back using solar power!

Residential Photovoltaic Solar Panels

A typical residential photovoltaic system costs between $15,000-$25,000 after rebates and incentives. Contemplating that you’ll most likely spend above $72,000 in electrical bills within the next twenty five years, this is easy math to see that the cost to cover photovoltaic panels installation is covered. However, for a lot of people, that signifies too big of an in investment. Generally, the payment per month is still under the cost of solar panels so you will save money on your utility bill. Additionally, solar energy panels will increase the value of your house too.

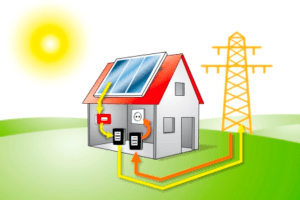

California Photovoltaic Rebates and Tax Incentives

California has many great rebate programs along with Federal rebates and Tax Incentives. These financial options will really make it simpler to pay for the solar energy systems for your home. Whether your home is in Sacramento Northern California, Los Angeles or San Diego maybe even Bakersfield, you will see a rebate and/or incentive that can help make California sun energy a real possibility for you personally. The Mr solar panel installer is going to be current on all of the relevant solar incentives based on where you reside in order to save you as much money as you possibly can.

California Energy Upgrades and Benefits

You will find a number of benefits of home photovoltaic energy: photo voltaic systems can reduce your electric power bills by 70% possibly even more — No longer will home owner’s need to pay 1000’s of dollars every year for their power companies.

Give us a call and find out how you can save thousands of dollars a year using solar power.